YNAB is not only a platform but also a whole new path over what you could do with each money you spend. It is ideal for anyone feeling encouraged to create a solid, innovative strategy to help each other raise funds, such as paying off the debt, having to spend less, or having saved more. On the other hand, those who merely would like to watch where they've paid their bills and obtain a real-time view of their overall total wealth in one spot may prefer Mint's more positive approach.

This article will help you determine which platform is ideal for your needs. We have examined the features, simplicity of setup and usage, compatibility, cost, and other factors to provide a side-by-side two leading Budgeting App Comparison.

Difference between YNAB and Mint

At their most basic, these two financial planning instruments achieve the same thing: they allow you to identify where and what you invest so that you may better organize your significant resources. YNAB, on the other hand, presents a much more forward-thinking method that is clearly distinguishable not just in its execution but also in the user's whole line of thinking.

Both of these applications need you to join your financial accounts, such as your online banking accounts, to their respective platforms to record every transaction. You will then be able to classify each transaction according to whether it was an income or an expenditure. After collecting this data, Mint can provide reports that detail how much you have spent in each spending category across a range of periods. This then gives you the ability to, if you so want, set budgetary limits for this month according to each of your different areas of expenditure. You might also just look at how your expenditure this month stacks up against your expenditure from the previous month or the same period a year ago.

When you use YNAB, on the other hand, making a plan is not a choice but a need; in fact, it is the foundation of the whole system and the YNAB viewpoint. YNAB describes their method as "giving every dollar a job," which means you decide at the beginning of each month what you will do with every dollar you get from your income.

Instead of just displaying what you have invested, YNAB asks you to assign a percentage of your income to the various costs you rank in order of importance. Sticking to that strategy instead of spending money haphazardly is all left to do at that point.

YNAB vs. Mint: Comparing Their Strengths

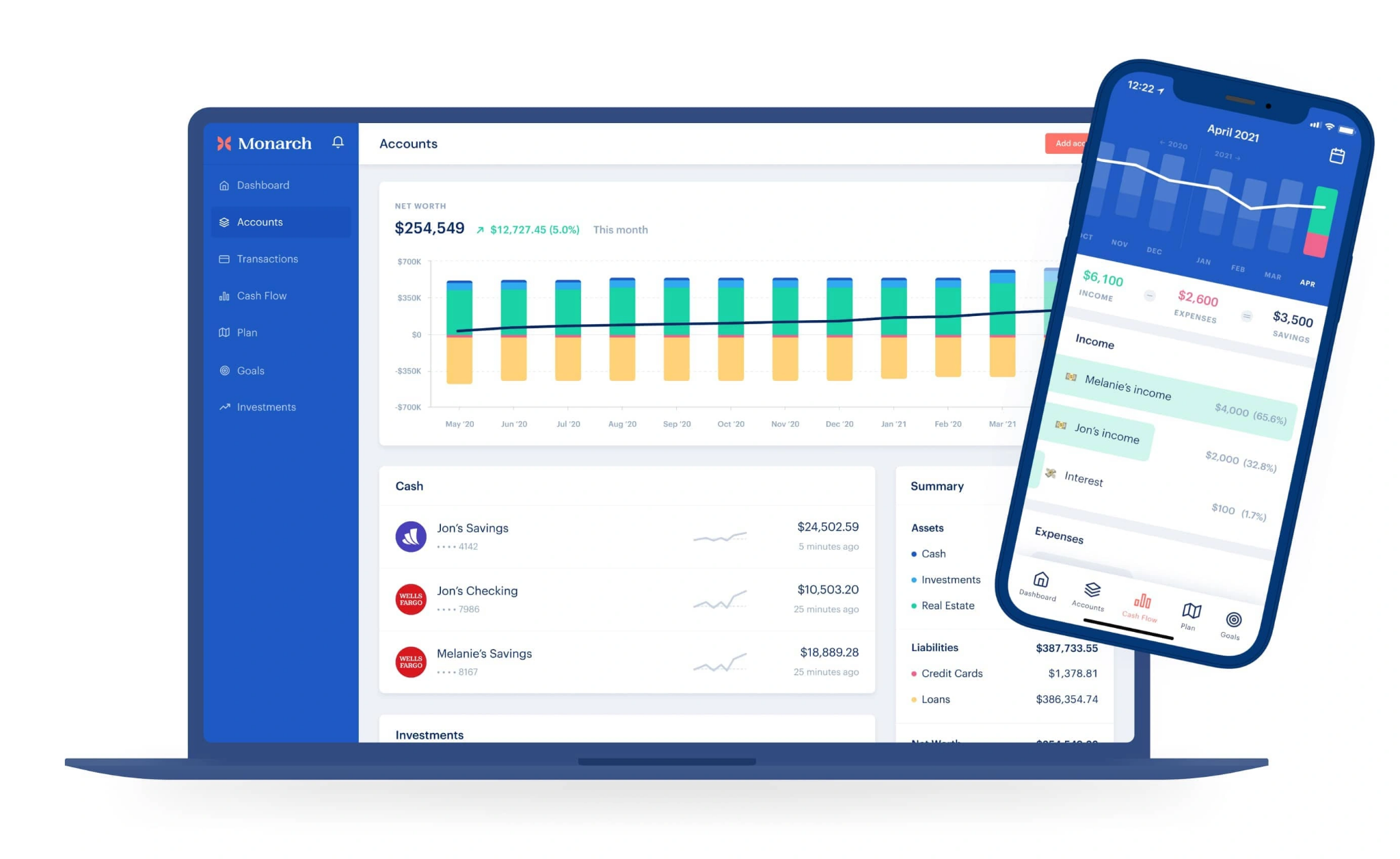

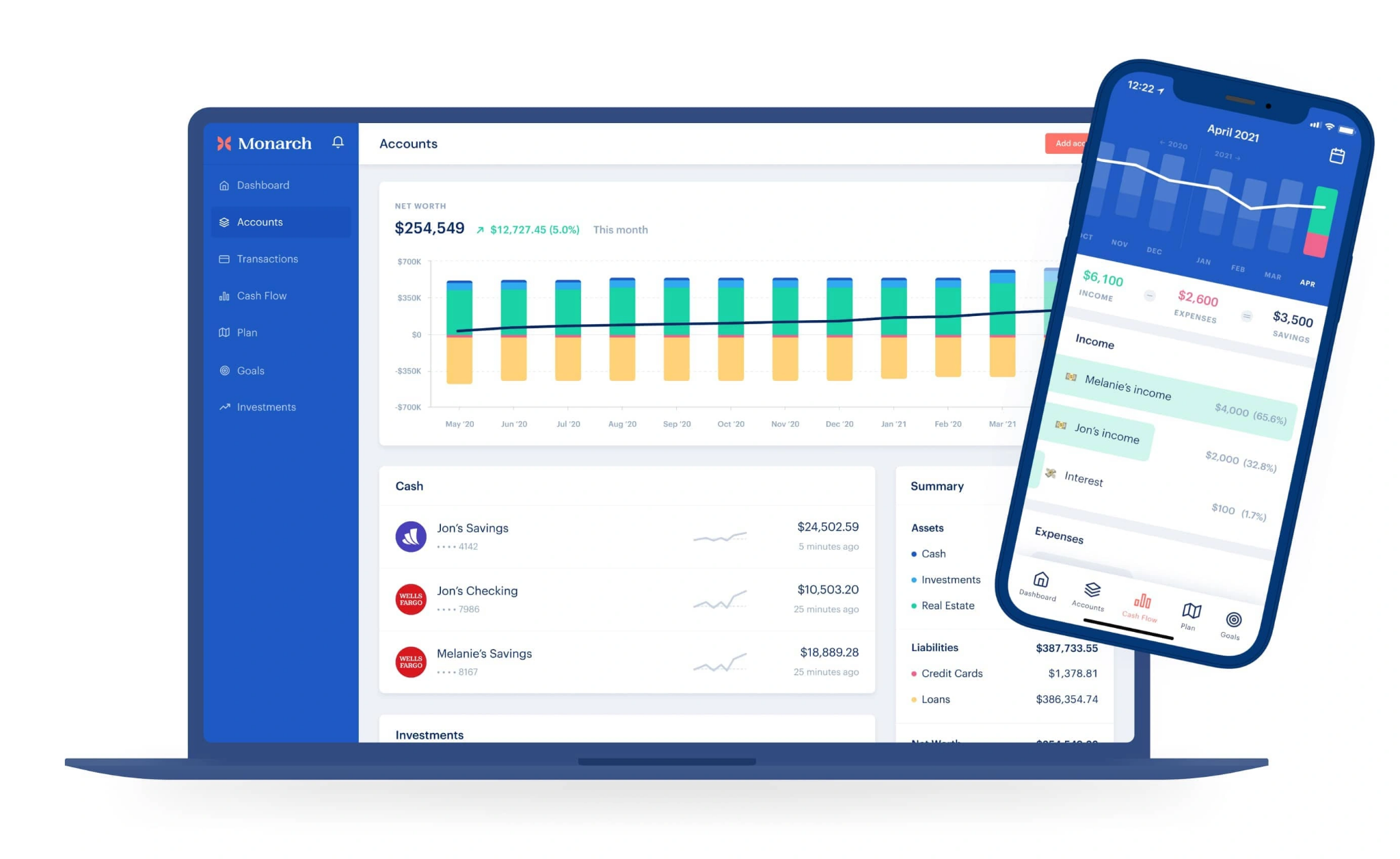

Two very different options, Mint and YNAB, offer registration views of personal accounts, in addition to the extensive digital ledger of all of your accounts, the option to set investment objectives, and a research section that enables you to pulverize your accounting transactions into a variety of different analytical perspectives.

In addition to keeping tabs on your banking records and transactions, Mint is also capable of keeping an eye on your monthly payments. Accounts you have connected, such as credit and debit cards, will automatically display in the bills area. These accounts will display information regarding the current amount, the minimum payment that is required, and the balance from the most recent statement. However, you may also include additional expenses, such as the payment for your mobile phone service or the monthly water bill. If the payment is your invoice, you can add a manual account for a payee that isn't part of the Mint ecosystem.

One of Mint's limitations is it doesn't permit users to personalize the system's categories. It is possible to add your subclasses to the current master classes. Still, you cannot change or delete any of the master sections or any of the subcategories that Mint has already developed. You are limited to just adding more subcategories to the list.

The UI of YNAB, on the other hand, gives you the ability to fully personalize your whole set of classifications, which makes it more appealing to individuals with specific preferences or spending kinds that are less conventional.

YNAB vs. Mint: Setting Up Your Account

The first step in using either app to keep track of your spending is to link all your different bank accounts. After determining the bank or other financial institution you maintain an account with, you will be requested to enter your internet username and password. After that, Mint and YNAB will create a dynamic relationship with your consideration, ensuring that you are kept apprised of any recent financial activity.

You may add mortgage or retirement investments to your Mint profile once you've finished adding all of your banking accounts. This enables you to monitor their current amounts as a part of the larger picture of your net worth displayed in Mint. However, you should be aware that these accounts do not permit the management or interaction of individual transactions. In other respects, it is a connection that can only be used to access the contents of these profiles.

The creation of an account in YNAB is only the first step. Based on the knowledge gathered from evaluating your previous expenditure, the planning process for how you will spend the following month's money is at the core of YNAB's methodology. After successfully setting up your account, the next important step is to allocate your dollars in the budget section of the app.

Difference Between YNAB and Mint: Which One Is Easier to Use?

The process of using Mint is relatively uncomplicated. After linking your institutions, the activities will begin to appear, and you will then classify them in evaluating your expenditures and determine the appropriate amounts for your budget. As you continue to use the application, you will have the ability to start accumulating a set of "rules" that will assist in the acceleration of processes by mechanically renaming and classifying any transactions it can identify based on your prior experience.

The relevant tab on the online interface or the app may be navigated to examine your budget, set or track progress toward savings objectives, or head over to see your reports. These functions can be simply accessible by navigating to the appropriate tab.

On the other hand, the user experience of Mint's desktop interface should be improved. While navigation is straightforward, the activity account is somewhat limited in size, especially when measured by YNAB's more intuitive and user-friendly design for the register. The dashboard for Mint, when accessed using an internet browser, is likewise a touch underwhelming.

Even though setting up an account with YNAB is straightforward, being proficient in budgeting monthly expenses might require some practice and education. YNAB lets you select beforehand where you will allocate each dollar of their income rather than consulting bank balances to determine how much money you need to be left to spend during a given month so that you may better budget it. This shift in strategy may take some getting accustomed to, but that's precisely what makes it so effective. YNAB is designed to alter how you think and approach your finances and the degree to which you are proactive in developing spending plans. It offers many videos and articles that might assist you so you can follow along.